He is the Emerging Market Manager strategy for Marketplaceplace relief in UBS

American exceptionalism dominates markets, with equities outperforming the rest of the world by 20 per cent last year alone. Yet one indicator, close to Donald Trump’s heart, remains exceptionally weak: the trade balance. We expect this to motivate new, China-centric tariffs. But rather than in China itself, we see larger market moves playing out in the rest of the emerging world for five reasons.

First, China is exporting its most powerful deflationary impulse in at least 30 years: its export costs have dropped 18% since its peak after the cinema compared to a 5% decrease worldwide, according to our research of the monitor knowledge World Trade of CPB. This de facto genuine renminbi depreciation has helped exports to dominate an invisible title since the first days of WTO adhesion. other emerging markets are basically channeled.

This goes beyond an undeniable return to having the improvement of Chinese products destined for the United States. This will not be the dominance of Chinese exports over the rest of the global emerging market markets. Instead, it reflects a non-stop walk in the production price chain and the export of excess capacity. The new costs deepened the latter, with consequences for production and Capex in emerging markets. Prices may be inflationary for the United States, however, the opposite will be true for those savings.

Some content could not load. Check your internet connection or browser settings.

Second, tariffs may accelerate a slowdown in Chinese imports that was already coming. Commodity imports have, thus far, decoupled from China’s slowdown amid robust infrastructure and manufacturing investment. New tariffs would exacerbate fiscal pressure and weaken profitability, challenging this resilience. As such, while manufacturing competitors to China have borne the brunt of its slowdown thus far, the next phase of growth deceleration will probably hit commodity exporters, too. Fiscal stimulus won’t compensate. That is tilting towards consumption — positive for the consumer and internet companies that dominate Chinese stocks — but with little spillover to broader emerging markets.

Recommended

Third, expansion is now slowing in giant parts of progression economies, markets are in a low position to navigate a potential industry war of 2. 0. China CONCRIMBO, where we see costs pass to GDP expansion to 3% next year, investment in emerging markets is locked in 2008 degrees as a component of GDP. Exports have also flattened and foreign direct investments are not increasing despite hopes of a “shot”. It is stronger in the form of a remnant of financial policy, but highly higher US rates restrict the ability of emerging markets to supply this without disrupting currencies and, in several cases, crediting differences.

Fourth, tariff industries such as cars, steel, shipping infrastructure and electric apparatus constitute a upper component of emerging marketplace actions, especially out of doors China, than in evolved economies. This vulnerability is undoubtedly reflected in the Chinese evaluations of actions, which have not recovered from the 1. 0 industry war, yet not in the rest of the emerging marketplaces where the evaluations are 30% upper in spite of a overall fairness return.

Content can be uploaded. Check your internet or browser connection settings.

Finally, emerging markets outside China also face more complicated advertising negotiations with Trump than ever. The composition of the American industry deficit has evolved significantly, so China now does not constitute “only” 27%, while the rest of the global markets of emerging markets is 55%. Defects with Mexico, Vietnam, Taiwan, Korea and Thailand have more quickly, which brings more uncertainty.

Some investors that are already worth such dangers after a recent low performance. We do not agree.

Recommended

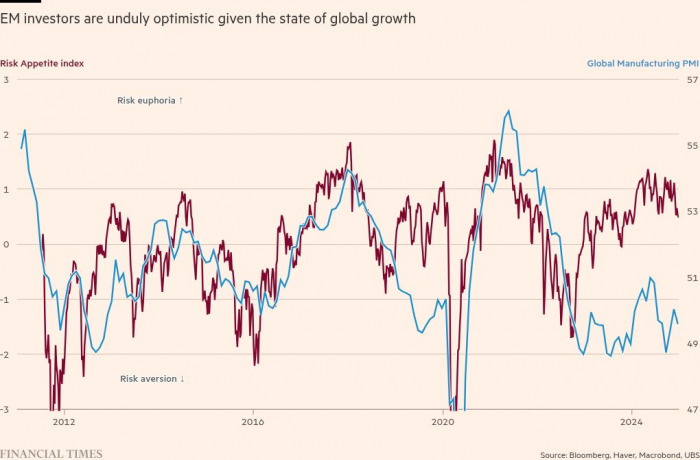

The threat appetite for emerging markets UBS is almost half threat neutrality and threat euphoria, atypically strong compared to the state of global expansion. Analysts expect a 14% earnings expansion in emerging markets in 2025-2026, as opposed to 4% in the 2018-2019 advertising spray. The acquisition protection charge opposed to part of the renminbi depreciation seen in 2018-2019 is in the quartile of decline from a 10-year range. Emerging-market credit streams across all scoring buckets have now compressed 18 cents or less of their distribution after the currency crisis. The biggest draw for emerging markets is rates and deflating major ones. This offers a steady source of income opportunities, on a specific local debt covered in money. But assets sensitive to expansion, movements and especially currency, seem vulnerable.